Start your UK Company with confidence

Your big idea deserves a bold execution.

Say goodbye to stress and hello to your new business.Whether you're ready to form an LLC on your own—or want advice every step of the way—we've got your back.

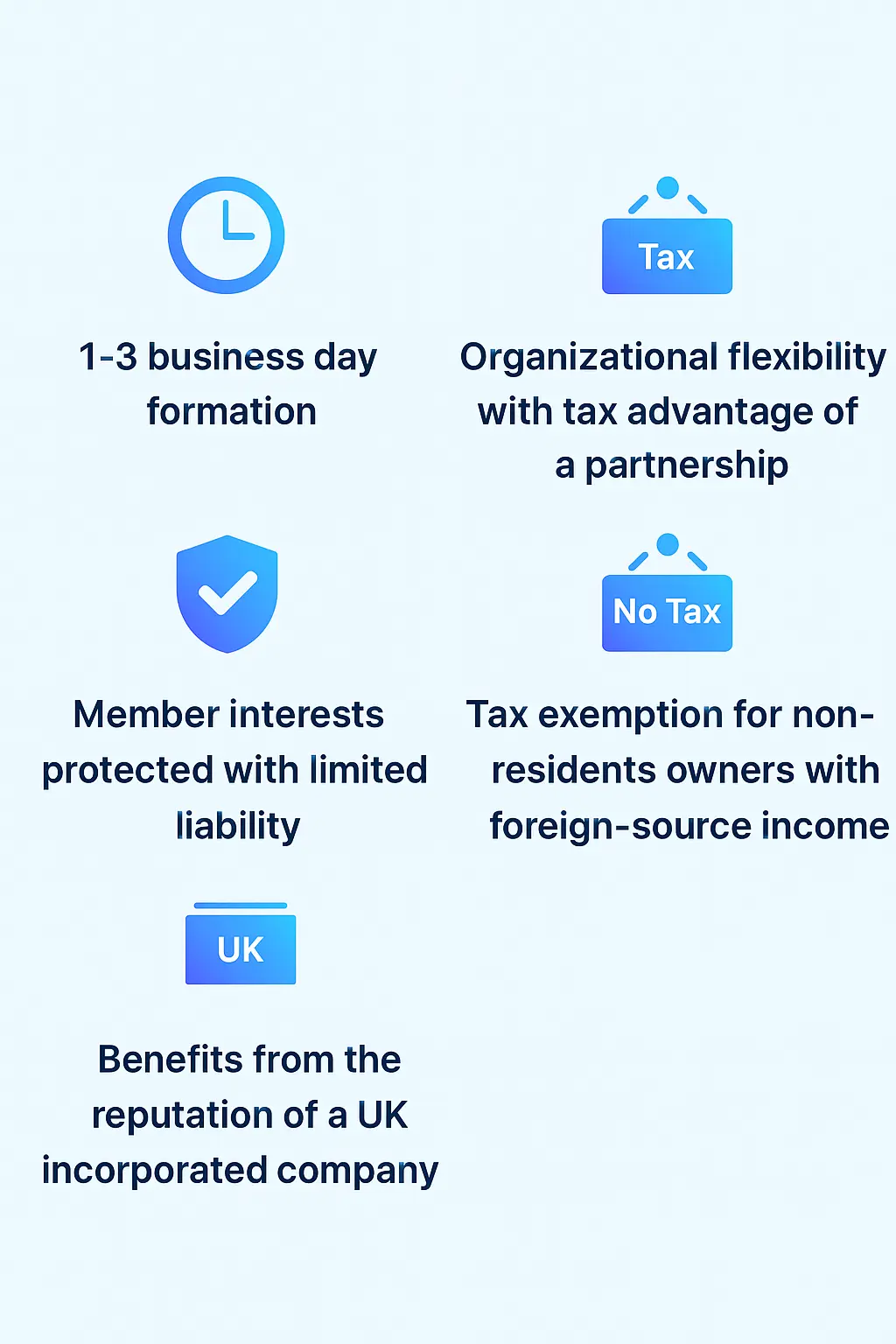

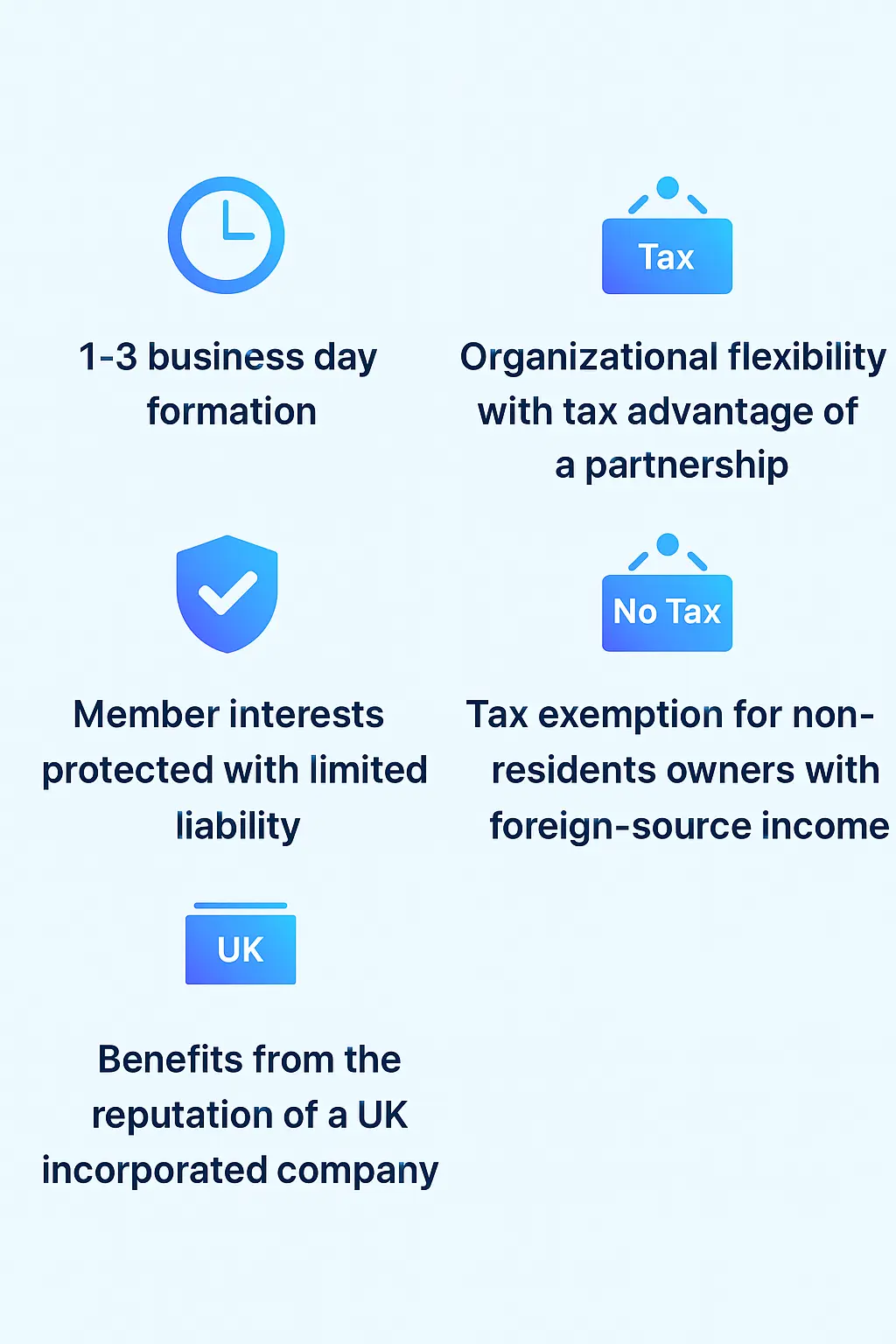

Benefit

Offshore Company Registration in UK

- The current corporate tax rate is set at 19%

- Ranked among top 10 countries worldwide for ease of doing business by the World Bank

- Supportive financial schemes accompanied by world-class infrastructure

- Having access to one of the world's largest network of double tax treaties (DTT) with more than 130 countries

- High-skilled labor force with a relatively lower cost compared to other European countries

LLP Formation and Set-up Cost

ONE PRICE, NO SURPRISES

- Limited Company

- Name availability check

- Documents Preparation and filing

- 01 Registered office address

- 01 year service address**

- Goverment fee's

- Copies of COI, LLP agreement

- Copy of company register

- Stripe account opening assistance

- Wise/Payoneer business banking

- Free Tax consultation

- Unlimited Chat, Phone and E-mail Support

C-Corp Formation and Set-up Cost

ONE PRICE, NO SURPRISES

- Name Check and Clearance

- Certificate of incorporation

- EIN official letter

- EIN official letter

- 01 year local registered address

- Registered agent service

- Business business bank account opening assistance

- Stripe account opening assistance

- Operating agreement

- FinCEN BOI Report filing

- Free Tax consultation

- Unlimited Chat, Phone and E-mail Support

Benefit

Offshore Company Registration in UK

- The current corporate tax rate is set at 19%

- Ranked among top 10 countries worldwide for ease of doing business by the World Bank

- Supportive financial schemes accompanied by world-class infrastructure

- Having access to one of the world's largest network of double tax treaties (DTT) with more than 130 countries

- High-skilled labor force with a relatively lower cost compared to other European countries

LLP Formation and Set-up Cost

ONE PRICE, NO SURPRISES

- Limited Company

- Name availability check

- Documents Preparation and filing

- 01 Registered office address

- 01 year service address**

- Goverment fee's

- Copies of COI, LLP agreement

- Copy of company register

- Stripe account opening assistance

- Wise/Payoneer business banking

- Free Tax consultation

- Unlimited Chat, Phone and E-mail Support

C-Corp Formation and Set-up Cost

ONE PRICE, NO SURPRISES

- Name Check and Clearance

- Certificate of incorporation

- EIN official letter

- EIN official letter

- 01 year local registered address

- Registered agent service

- Business business bank account opening assistance

- Stripe account opening assistance

- Operating agreement

- FinCEN BOI Report filing

- Free Tax consultation

- Unlimited Chat, Phone and E-mail Support

How to Open a Bank Account for a U.S. Company

One of the first and most important steps when launching your business in the United States is opening a business bank account. This keeps your company’s income and expenses separate from your personal finances, which strengthens limited liability protection, simplifies tax reporting, and builds credibility with clients, suppliers, and investors.

When it comes to U.S. companies, there are a variety of options for setting up your business account:

1. Applying at a Local Bank in the U.S.

The United States is home to one of the largest and most developed banking systems in the world, with thousands of commercial banks, community banks, and credit unions. It has a well-established regulatory environment overseen by multiple authorities such as the Federal Reserve System, Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC).

Banks in the U.S. are generally divided into two categories:

- National banks – operating across the country under federal charters.

- State-chartered banks – licensed and regulated at the state level but still subject to federal oversight.

The U.S. offers a wide range of banking services, from traditional checking and savings accounts to specialized treasury management, merchant services, and business loans. Opening a business account locally typically requires:

- Company formation documents (Articles of Incorporation/Organization)

- Employer Identification Number (EIN) from the IRS

- Valid identification for all beneficial owners

- Proof of address (for the company and sometimes for directors)

2. Opening an Offshore or International Bank Account

A U.S.-incorporated company does not need to limit itself to domestic banking. Many businesses open accounts abroad to take advantage of global payment capabilities, currency diversification, or access to specific financial services.

International accounts can be set up in jurisdictions that offer strong privacy, flexible account structures, or specialized trade finance facilities. However, U.S. companies are subject to FATCA (Foreign Account Tax Compliance Act) and must comply with U.S. tax reporting obligations, even for foreign-held funds.

3. Considering Online Banks and Fintech Solutions

In addition to traditional banks, the U.S. has a rapidly growing fintech sector offering digital-first business accounts. These platforms can provide fast account opening, integration with accounting software, and competitive fees for international transfers. Examples include online banks, payment processors, and neobanks that cater to startups, e-commerce sellers, and freelancers.

We are partner with Best

We help you navigate the process and connect you with banks that accept non-residents. Your business deserves to grow without borders!

Requirements You Need to Open a Bank Account as a Non-Resident

Additional supportive documents beyond the listed below might be requested to open your US company bank account depending on each local regulation, your business fields, and on a case-by-case basis.

Please get in touch with us to know the exact essential documents for your case.

Company documents

EIN official letter

Passport copy

Local bank statement

Complete business website

Phone number

Business mail with access

Our Menu

Savor our fresh, local cuisine with a modern twist.

Deliciously crafted for every taste!

✽ True copy of certification services

-

Apply for ITIN

US$350

We have 110% refund policy for ITIN, Our success rate is 100% so we assure we will get your ITIN. If we fail, we pay 10% more back to you as a direct 110% refund without an additional conversation.

- Apostille US$299 Apostille certification is a formal name for a bureaucratic procedure, by which official documents issued in one country are certified in a uniform way, so that they become formally acceptable in a different country.

✽ Document Retrieval Services

-

Certificate of Good Standing (short form)

US$150

A Certificate of Good Standing (CGS) is an official document, issued by the Registry of Companies. A CGS confirms that a particular company legally exists, has complied with all the administrative requirements as to its continued registration and has paid all government duties, and, therefore, is “in good standing” vis-a-vis the Companies Register as of the date of issue.

-

Certificate of Incumbency

US$185

CI of an offshore company is an official attestation issued by its registered agent or authorities of the jurisdiction of incorporation which states the person(s) listed is (are) the actual director/shareholder of the company. CI is mandatory for opening a corporate bank account.

✽ Legal Administration

-

Change of company name

US$600

We help you to check your company name's uniqueness, ensure legal compliance and file name change to the Registrar and other relevant local authorities.

-

Change of company members

US$600

Price applied per filing

-

Increase number of shares

US$600

Authorized capital is the maximum amount of capital a company can raise through shares and is stipulated in a company's constitutional documents. You might wish to increase the registered capital to issue new shares or increase paid-in capital.

-

Dissolve or close an LLC or a Corporation

US$600

Closing down an LLC/Corporation involves several steps that include filing certificates of dissolution/cancellation to be officially recognized. By using our service, we will consult and help you prepare documents for filing to the Division of Corporations.

✽ Nominee Services

-

Nominee Director / Manager

US$699

Nominee director service helps remain privacy of beneficial owner while maintaining real power on the administration of the company. The service includes one nominee director / manager for 1 year with supporting documents (if any), such as PoA and undated signed resignation letter.

-

Nominee Shareholder / Member

US$699

Nominees shareholder service helps maintain your privacy by not display your name on public document of the register of shareholder. The service includes one nominee shareholder / member for 1 year with supporting documents (if any), such as DoA and undated signed request of share transfer. It helps to remain the privacy of the beneficial owners.

-

Nominee Director & Shareholder

US$1,299

The service includes one nominee director and one nominee shareholder for a Corporation for 1 year with supporting documents (if any), such as PoA and undated signed resignation letter.

-

Nominee Manager & Member

US$1,299

The service includes one nominee manager and one nominee member for an LLC for 1 year with supporting documents (if any), such as PoA and undated signed resignation letter.

✽ Other services

-

EIN application

US$150

Employer Identification Number (EIN) is also known for Federal tax id. This would be required should you need to hire employees or apply for a bank account in the U.S.

-

Physical Shipping

US$169

Our Physical Shipping service offers reliable, secure, and efficient delivery of important documents and paperwork to both local and international destinations.

Tax Filing Package for USA

Business Volume | Single Member LLC Price | Multi Member LLC Price |

No business(zero) | $ 199 | $ 269 |

$1,000 – $10,000 | $ 249 | $ 389 |

$10,001 – $50,000 | $ 299 | $ 499 |

$50,001 – $150,000 | $ 749 | $ 829 |

$150,001 – $250,000 | $ 1199 | $ 1249 |

Above 250,000 | custom price | custom price |

✽ What We Offer

US Company Incorporation Process

Place Your Order & Choose Your Package

Enter our online order platform for a smooth onboarding experience. Select from our various packages and additional services that match your goals. All submitted information is secured with 256-bit encryption.

Make Payment & Submit KYC Documents

Pay via flexible options including Visa, MasterCard, Amex, or bank transfer. After payment, you’ll receive a checklist for Delaware company registration and complete your KYC through our secure online form. Our team will guide you in preparing all necessary documents.

Complete Company Registration

We’ll process your incorporation in Delaware and provide electronic documents within 2 working days. Full completion, including state processing, takes 3–7 days, and you can track progress anytime through our Client Portal.

KYC Documents Checklist

The following proofs are required for all company members including Directors (or Managers for LLCs), Shareholders (or Members for LLCs), Ultimate Beneficial Owners (UBOs), and Contact persons.

- A certified true copy (scanned version) of the passport (valid for at least 6 months);

- Email address and phone number;

- A comprehensive Curriculum Vitae (C.V.), Resumé, or Linkedin profile.

We require certified true copy (scanned version) of address proof, which can include any of the following: Bank reference / Bank statement / Utility bill / Driver license.

The address proof must clearly show the holder's full name along with physical address written in English (P.O. Box addresses are not accepted).

Please note that the provided proofs must be the most recent version and dated within the last 3 months.

To establish the identity of a corporation or entity, it is necessary to provide company documents and proofs of its members.

- Please provide us with certified true copy (scanned version) of the following company documents:

- Certificate of Incorporation;

- Memorandum and Articles of Association / Constitution;

- Register of Director;

- Register of Shareholder / UBO;

- Extract of the company’s details from the Registrar of Companies, which can include any of the following: Business Profile / Certificate of Incumbency / Certificate of Good standing (valid for within 6 months if any).

- Note: in case the company documents can be certified via official government site, there is no need to submit certified copies.

All members of the corporation, including Directors (or Managers for LLCs), Shareholders (or Members for LLCs), Ultimate Beneficial Owners (UBOs), and Contact persons, must provide identity and address proofs.

Need more help to set up your business in Delaware

Just get in touch with us. We typically response within 2 hrs.

Our latest content

Check out what's new in our company !